One of the most common questions I get from investors looking at tequila casks is, ‘’Why now?’’.

One of the key answers lies in something very simple, but incredibly powerful… the agave cycle.

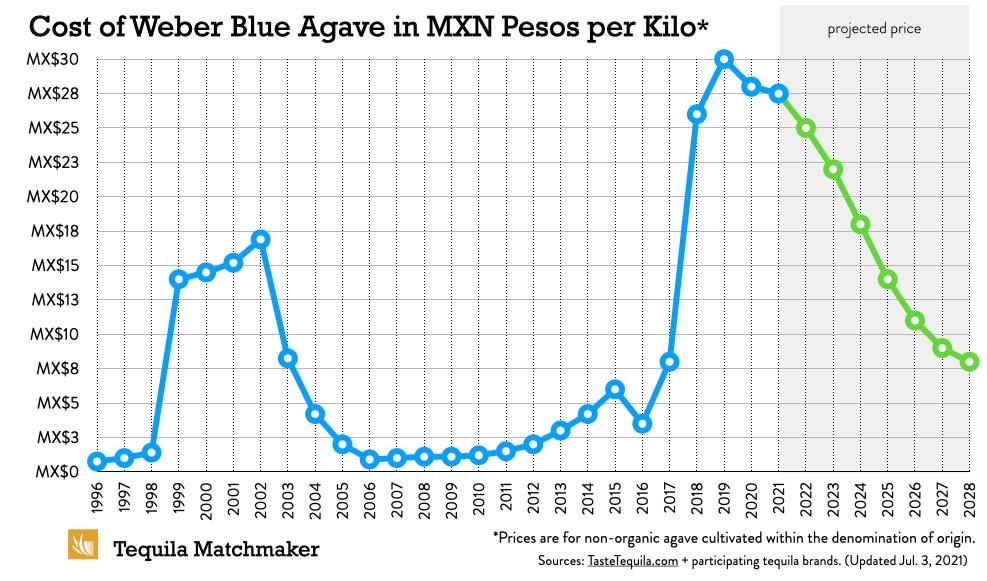

The tequila industry operates in long, predictable cycles, usually around 10 to 15 years, driven almost entirely by the supply and demand of one plant… the Blue Weber agave. When agave is abundant, prices drop. Distilleries can produce more, and buy-in prices for new tequila casks are low. But when supply tightens, and it always does, prices surge, and when that happens, the value of existing tequila casks rises significantly.

Right now, we are in the tail end of a surplus phase. Agave prices have been at historic lows, which means it’s currently a buyer’s market. Casks can be acquired at extremely attractive entry points, especially when working directly with premium producers.

But here’s where it gets interesting: because prices are so low, many agave farmers have already stopped replanting. It’s no longer economically viable for them to keep up the same output. And because agave takes roughly 7 to 10 years to mature, any gap in planting today creates an inevitable shortage down the line.

We’ve seen this cycle play out time and time again. After a surplus, the market swings sharply in the other direction. Agave becomes scarce, prices spike, and the cost to produce tequila increases dramatically. We’re already starting to see the early signs: agave reserves are thinning, buy-in prices slowly are beginning to rise, and global demand for tequila, especially premium, additive-free expressions, continues to soar.

For tequila investors, this creates a very strategic window. Buying casks now, while prices are still low, means positioning yourself before the next shortage hits. And when it does, producers will be paying more for agave, production volumes will tighten, and the value of aged tequila already in cask is likely to climb.

At GORDON Premium Spirit Investments, we’ve helped clients secure casks from some of the most respected distilleries in Mexico at exactly the right time in the cycle. These aren’t just speculative plays; they’re grounded in long-term market patterns that have played out consistently for decades.

So if you’ve been considering tequila as an alternative asset, this is very much a moment to act. The cycle is turning, and when the shortage hits, it’s the early buyers who benefit most.